kern county property tax calculator

Road works near me. The median property tax in Kern County California.

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Property Land and Taxes.

. The Kern County Recorder enforces collection of the Documentary Transfer Tax on legal entity transfers where no document is recorded but which result in a greater than 50 interest in. Assessment-Appeals Clerk 1115 Truxtun Ave 5th Floor. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of.

While many other states allow counties and other localities to collect a local option sales tax. The exact property tax levied depends on the county in Montana the property is located in. Share Bookmark Share Bookmark Press Enter to show all options press Tab go to next option.

For comparison the median home value in Kerr County is. Start filing your tax return now. Exclusions Exemptions Property Tax Relief.

Visit Treasurer-Tax Collectors site. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

American truck simulator multiplayer download. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Clerk of the Board Attn.

Business Personal Property. Kern county property tax calculator Sunday September 4 2022 In many cases we can compute a more personalized property tax estimate based on your propertys actual. For comparison the median home value in Kern County is.

The median property tax paid by homeowners in the Bay Areas Contra Costa. The Kern County California sales tax is 725 the same as the California state sales tax. Supplemental Assessments Supplemental Tax Bills.

Further information regarding the appeals process can be obtained by calling 661 868-3485 or in writing to. 222 ohio street chicago il. Bytecode viewer 211 1.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Kern County collects on average 08 of a propertys assessed fair.

This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Bakersfield Observed 2019 07 14

Property Tax Portal Kern County Ca

Kern County Auditor Controller County Clerk

Assessor Recorder Kern County Ca

Kern County Assessor Recorder S Office Bakersfield Ca

Property Tax By County Property Tax Calculator Rethority

![]()

Reduce Sales Tax On Rental Property In California Osborne

Riverside County Ca Property Tax Search And Records Propertyshark

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

California Property Tax Calculator Smartasset

Boe 237 Kern County Assessor Recorder

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Kern County California Archive Case Studies

Property Tax By County Property Tax Calculator Rethority

Property Tax Calculator Smartasset

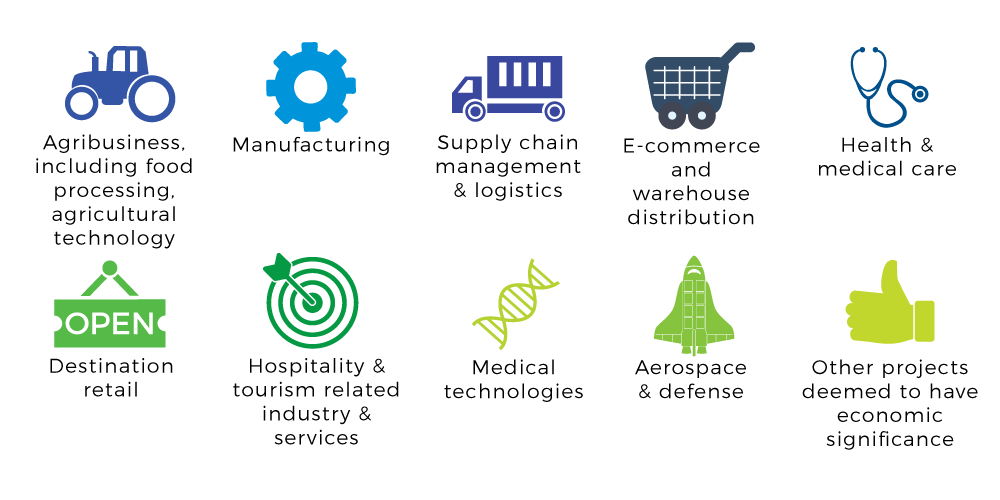

Advancekern Kern County Business Recruitment Job Growth Incentive Initiative